Setting up a travel agency

14 Apr, 2023

14 Apr, 2023

LOOKING TO SET UP YOUR TRAVEL AGENCY IN IRELAND

With the incentives offered by the Government of Ireland to promote business and economic activity in Ireland, the promotion of the tourism industry in Ireland is no exception. As a result, it is an attractive investment opportunity for both local and foreign investors. Let us now explain all the ins and outs of starting your business as a travel agent in Ireland.

What are the Legal Requirements Concerning the Travel Agency Business in Ireland?

The Transport Act 1982 governs the travel agents and tour operators in Ireland. It was revised in the year 1995, whereby the Travel Trade Act and Package Holiday features were added. The framework requires every person wishing to operate a travel agency in Ireland to acquire a specific travel agency license. The license is obtained from the Travel Trade Licensing Commission for Aviation Regulation.

The legal structure for the travel agency business could be in the form of a sole trader, partnership or limited company. If you go ahead with librarianship or limited company forms of business, getting registered with the Companies Registration Office (CRO) is essential. The company should apply for the license above to operate as a travel agency. You also need to check the share capital requirements when setting up a limited liability company-run running things travel agency business. Our Support Agents can provide all the excellent scary information to get started and help you register your business with the CRO.

Features of the Travel Agency License

⦁ The two types of license options available the travel agents and tour operators.

⦁ The license will enable the applicant to offer travel packages for overseas travel to destinations outside Ireland, sell commission-based tourism packages and receive payments for tourism packages sold.

⦁ The license is valid for a year (12 on this). A renewal is required each year.

What are the Applicable Fees for Issuance of the Travel Agency License?

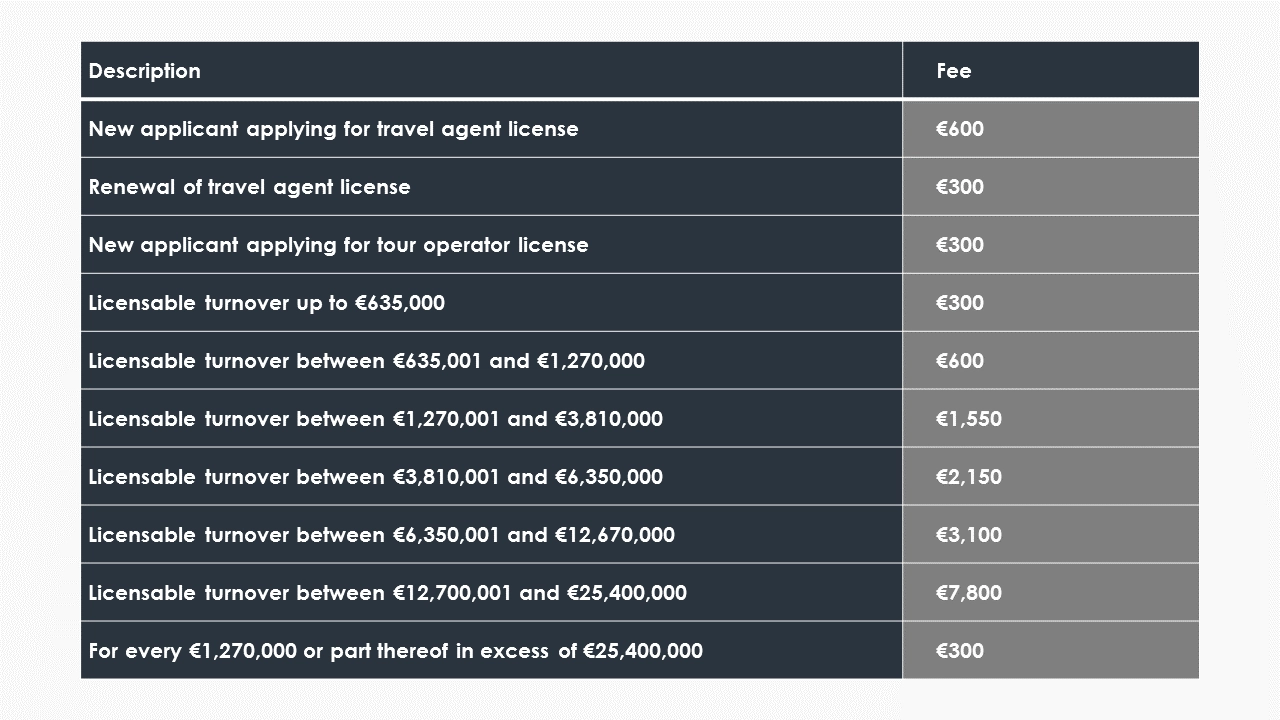

Different fees are applicable depending on whether you obtain a travel agent or tour operator license. Furthermore, tour operators are charged a fee based on their projected licensable turnover in addition to the new applicant fee of €300.

Provided the fees are non-refundable, and where the entity holds the licenses, it will be liable to pay both fees.

Also, where the entity changes from a partnership to a sole trader or from a sole trader to a limited company, this will be deemed a new application and, therefore, will be charged €300.

How Can Fusion Formations Assist You?

Get a flying start on your travel agency business in Ireland with us. We have helped numerous clients to get started and stay compliant with the regulations of Ireland. So, give us a call today for more information.

get a quick quote

Post Category

- Banking (1)

- Company Formation (3)

- Guides (6)

- Uncategorized (28)