Closing Down Your Company In Ireland

23 Dec, 2022

23 Dec, 2022

Do you need to close down your company in Ireland and help figure out how to proceed? Our guide below explains the whole process of company closure in detail.

Strike-off of a company is not always involuntary. There may be circumstances where the management decides to close the company or strike off a company from the Register of companies maintained with the Companies Registration Office (CRO). Instances of such circumstances include the retirement of directors, cessation of trading activity or restructuring of the company into a new entity. In these cases, it is better to go for the company’s closure rather than keeping it open and continuing to bear the responsibilities of compliance requirements like Annual Return filing etc. Before closing down the company, it is vital to know the essentials of the strike-off procedure. For any questions and queries, contact one of our support agents, who will guide you through the best course of action.

What Criteria Should Be Met Before Proceeding for Voluntary Strike-off?

Before proceeding with the voluntary strike-off, the company should ensure that the following conditions are met:

- No business activity or cessation of all trading activity.

- Settlement of all outstanding debts to

- Distribution of business assets among the stakeholders.

- Assets or liabilities of the company do not exceed €150.

- All due Annual Returns have been filed with the CRO.

It is also helpful to inform those affected by the company closure, such as employees, suppliers and customers. Also, be sure to close the company’s bank account and any website domains.

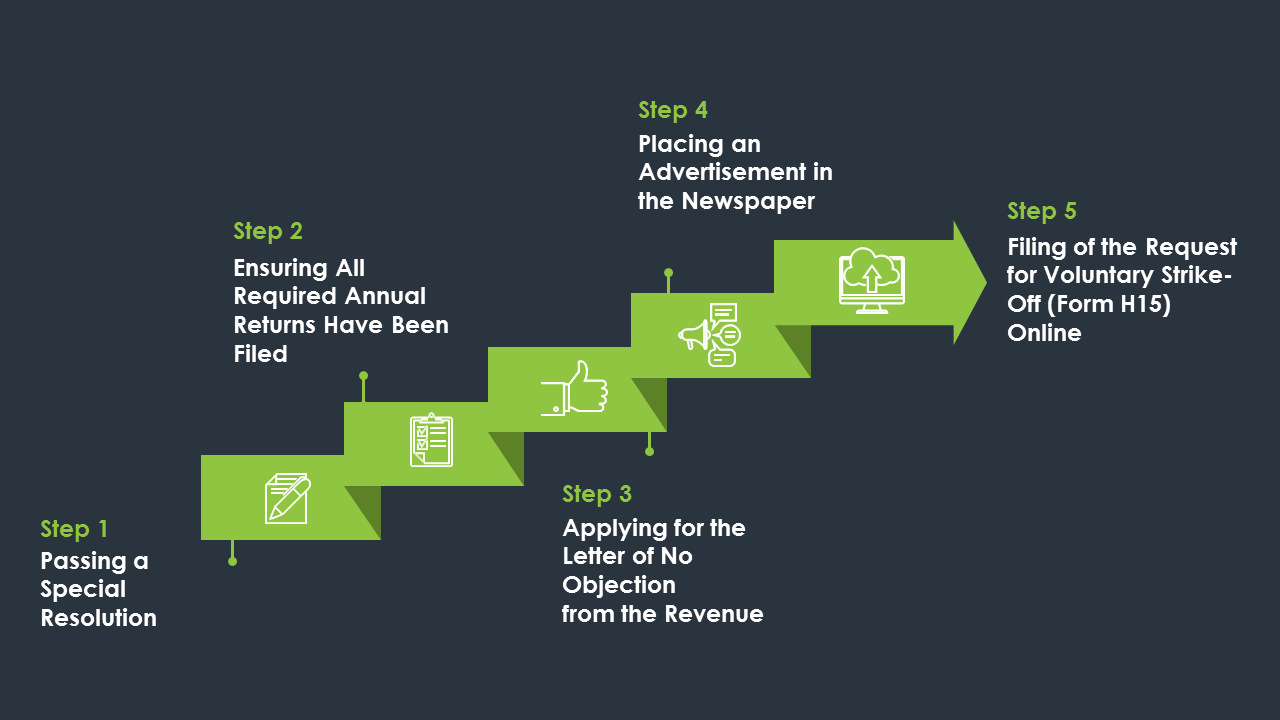

Step-by-Step Procedure of Company Closure / Voluntary Strike-off

Company closure can be a long and complex process and can take up to 6 months after initiating the process to finalise the closure. The Request for Voluntary Strike-off is filed online on Form H15. To help you understand the entire procedure, we have listed the essential steps and a concise description of each.

Step 1 – Passing a Special Resolution

The first step towards closing a company is to pass a special resolution to this effect. It is important to note that the resolution must be given within a period of 3 months before applying to the CRO for the voluntary strike-off. The resolution should also include the fact that the company will not carry any business or incur any liabilities during the time when the application is pending with the CRO for the final decision.

Step 2 – Ensuring All Required Annual Returns Have Been Filed

Before you go ahead with making the Request for Voluntary Strike-off, it is important that the company has filed all the outstanding Annual Returns along with payment of the filing fee and late filing fee (where applicable).

Step 3 – Applying for the Letter of No Objection from the Revenue

The CRO requires a letter of no objection from the Revenue Commissioners in respect of your company to be submitted at the time of filing Form H15. This is to ensure that the company has no outstanding obligations towards the Revenue, which could be in respect of non-filing of tax returns or unpaid tax bills/filing fees.

The application for obtaining a Letter of No Objection should be in the form of a written request. It is also essential to make sure that the letter of no objection is dated no more than three months prior to the date of submitting Form H15 online.

Step 4 – Placing an Advertisement in the Newspaper

The final step before filing the Request for Voluntary Strike-off is to get an advertisement published in a daily newspaper, notifying the general public of the intention to close the company. The entire page of the newspaper, showing the date of publication, the name of the newspaper and the advertisement clearly marked, must be submitted as a PDF copy along with Form H15.

The advertisement should not be dated 30 days before the date of submitting Form H15. So, it is important to get done with the above-mentioned steps first and then proceed with publishing the advertisement.

Step 5 – Filing of the Request for Voluntary Strike-Off (Form H15) Online

After you are done with completing all the above compliance requirements, you are now ready to file the Request for Voluntary Strike-off. This is done by filling in Form H15 online on the CORE website. Earlier, the resolution for company closure was filed separately on Form G1-H15. After the implementation of a new filing portal on the CORE website, all the documents are uploaded in PDF format now.

Once you fill up all the required particulars on Form H15, upload all the necessary documents and pay the filing fee of €15, the process of requesting company closure is complete.

How Do I Ensure That My Company Has Been Struck Off the Register?

Once you have submitted the Request for Voluntary Strike-off and it has been accepted, your company’s status on the CRO website will appear as ‘Strike-off Listed’. However, the closure is still subject to objection at this stage.

Where your company remains on the ‘Strike-off Listed’ status for a period of 90 days, and no objection has been received against the strike-off during this time, it will then appear as ‘Dissolved’ and is, therefore, finally closed.

Can A Company Request Cancellation of the Strike-off?

Yes, a company can request cancellation of its strike-off by submitting a notice to the CRO on Form H17; this should be done within 90 days of the change of the company’s status on the CRO website.

What Does Involuntary Strike-off Mean?

In contrast to the Voluntary Strike-off, a company may be forced by the CRO to close. This is called Involuntary Strike-off. Situations that might give rise to an Involuntary Strike-off include those related to non-compliance with the law. For instance, where a company fails to file its Annual Return, does not appoint a Company Secretary or fails to fulfil the requirement to appoint an EU or EEA resident director, the CRO will proceed to strike off the company from the register.

Need to Seek Professional Advice Regarding Your Company’s Closure?

We assist our clients on their journey to closing their company. Our team is well-aware of all the necessary documentation for the Voluntary Strike-off and the timelines to adhere to when executing such documents. Talk to one of our Support Agents today to discuss all the aspects in detail.

get a quick quote

Post Category

- Banking (1)

- Company Formation (3)

- Guides (6)

- Uncategorized (28)