Deciding Between Sole Trader And Limited Company

20 Jan, 2023

20 Jan, 2023

When setting up their business, many entrepreneurs are unsure whether to go for a Limited company or work as a Sole Trader. When deciding which one would suit your business best, many factors come into consideration. It is not like a one-size-fits-all solution. Our guide will help you determine each option’s pros and cons, and you will be in a better position to make an informed decision as to the best-suited option for your business.

What is a Sole Trader?

When you set up your business as a Sole Trader, it means that you have unlimited liability. You and your business are treated as one. You are personally responsible for your business, and if the business incurs any losses or owes any debts, your money and personal assets will be used to settle them.

What is a Limited Company?

Where you run your business as a Limited Company, it means that a separate legal entity has been created, and its ownership is split into shares. The business finances are kept separate from your personal finances. If the business incurs a loss or owes debts, your liability as a shareholder/director will then be limited to the amount unpaid on any shares you hold.

Before comparing the advantages and disadvantages of setting up as a Sole Trader or Limited Company, let us first explain the factors that would affect your decision about which one to go for.

Factors to Consider When Deciding Between a Sole Trader or a Limited Company

Certain factors will help you determine which option will suit your business more. We have helped many of our clients make an informed decision regarding this. Since the decision depends on your circumstances and personal choice, we would strongly recommend talking to our Support Agent, who can help you shape the best answer to this question.

Estimating the amount of tax liability on the money you earn

Since running your business attracts tax liability, you need to consider the level of income that you expect to earn. In the case of a Sole Trader, whatever you earn minus the deductible expenses will be charged to tax. These could be charged at a rate of tax as high as 55%, and you would end up having a huge tax bill.

On the other hand, paying yourself as a limited company director gives you more options to structure your incomings from the business income. These could take the form of a salary, dividends, and reimbursement of expenses. While the company deducts income tax and other applicable charges from your salary, your salary and expenses are allowed as deductible expenses for the limited company, reducing the company’s taxable profit. The corporation tax is also set at a considerably lower rate of 12.5% for most companies (where the directors are residents of Ireland).

Assessing the nature of risk involved in your business activities

If your business involves industries with more chances of the customers/clients’ claiming damages, then it is best to set up as a limited company so that you may not have to put your personal assets at risk. Also, where you render professional services like accounting or bookkeeping, it is better to set up a limited company since it enhances the credibility of your business.

Considering the long-term growth prospects for your business

Where you have forecasts of a profitable business making money within, say, 5-10 years, you can consider starting as a Sole Trader and then move ahead with establishing your business under a limited company. In other words, wynn your business starts to produce profits above what you need as a monthly take-home (salary) covering your personal expenses, it is better to set up a limited company and withdraw any excess as dividends or costs.

Comparison Between Operating as a Sole Trader or as a Limited Company

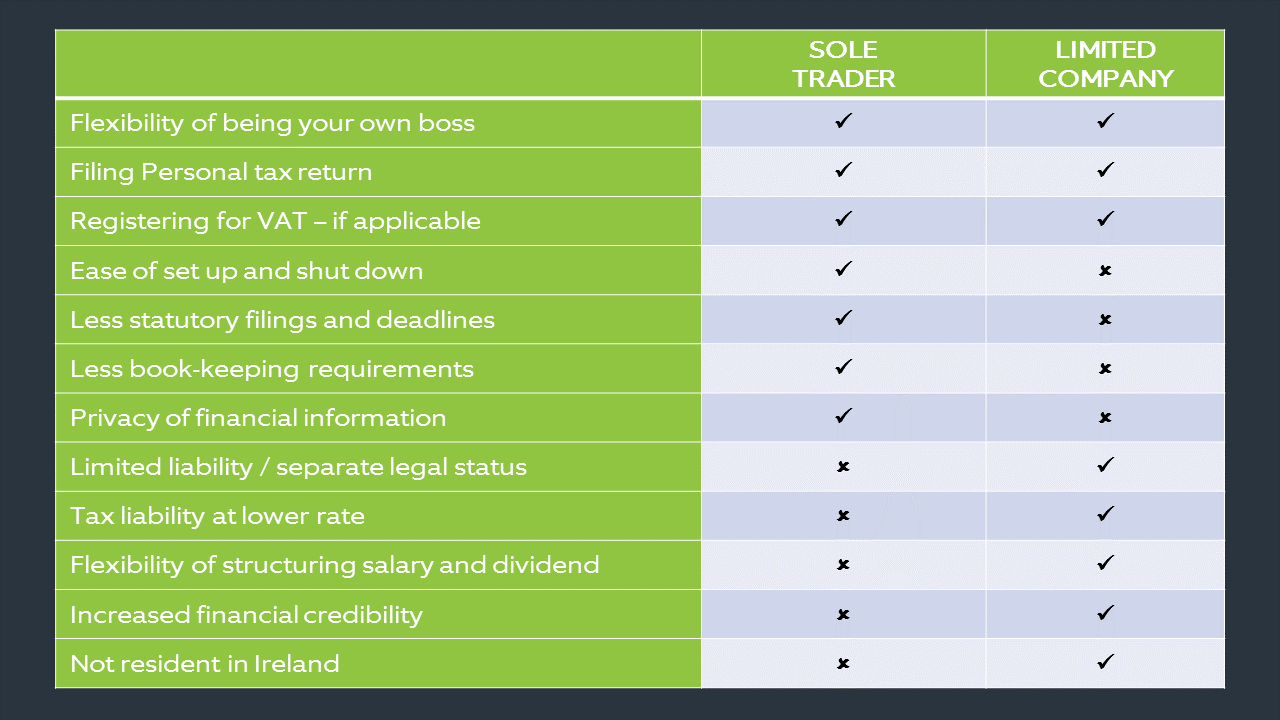

We have summarised the main points of comparison between setting up as a Sole Trader or a Limited Company. This will provide you with a glimpse of what both options have to offer.

The Way Forward……

It is of prime importance that you are aware of all the practical aspects of the compliance matters in setting up either as a Sole Trader or as a Limited Company. Most businesses start by taking care of the book-keeping issues themselves and then proceed to hire an accountant/book-keeping service when the business gears up to expand. You may also wish to outsource the company’s secretarial and compliance matters to us so that you have the peace of mind of not running into non-compliance and can focus well on growing your business.

You can initially start as a Sole Trader. When the business begins to flourish, you can convert to a Limited Company and obtain all the benefits of being a corporate entity. In every case, we recommend seeking advice from a professional before deciding on going ahead for a Sole Trader or Limited Company setup by discussing your circumstances. Get in touch with us today at 00353 1 4013286.

get a quick quote

Post Category

- Banking (1)

- Company Formation (3)

- Guides (6)

- Uncategorized (28)