Move your UK company to Ireland

15 Mar, 2023

15 Mar, 2023

RELOCATING YOUR UK BUSINESS TO IRELAND

Ireland, with its business-friendly environment, is an attractive option for businesses worldwide to establish their presence and enterprises operating in the UK. Ranked by Forbes among the best countries for a business setup, Ireland is a gateway to access the European markets owing to its strategic location. It also offers businesses excellent tax incentives/savings and a robust regulatory and legal framework. Following Brexit, it has become ever more critical for companies in the UK to establish their business entity in Ireland. Let us first look at the advantages of relocating your business to Ireland.

Advantages of Establishing Your Business in Ireland

- Attractive tax environment – With the tax initiatives designed to promote business activity in the country, Ireland has become a preferred choice for business owners offering a lower corporate tax rate of 12.5% and allowing generous tax credit schemes. However, it is essential to demonstrate that the business is centrally controlled and managed in Ireland and has a considerable economic benefit to Ireland’s economy.

- Saving on customs duties – With easy access to the European Economic Area (EEA), moving the business to Ireland brings the added advantage of hassle-free paperwork and not having to pay customs duties/tariffs for trade between Ireland and other EEA member states.

- Skilled workforce – Besides providing a conducive environment for businesses, Ireland has the advantage of having one of the most skilled workforces in the world. Moreover, it has a record of helping youth to acquire work-related skills.

With all these factors giving you an edge when having a presence in Ireland, it is equally important to be cognizant of the statute’s requirements. We now explain these aspects to give you a better perspective for relocating your business to Ireland.

Options for Operating Your UK Business in Ireland

⦁ Setting up an Irish holding company for the UK company.

⦁ Creating a subsidiary company in which the British company can have full or partial shareholding.

⦁ Establishing a branch office in Ireland.

⦁ Registering a company in Ireland and transferring the operations and assets from the UK to Ireland.

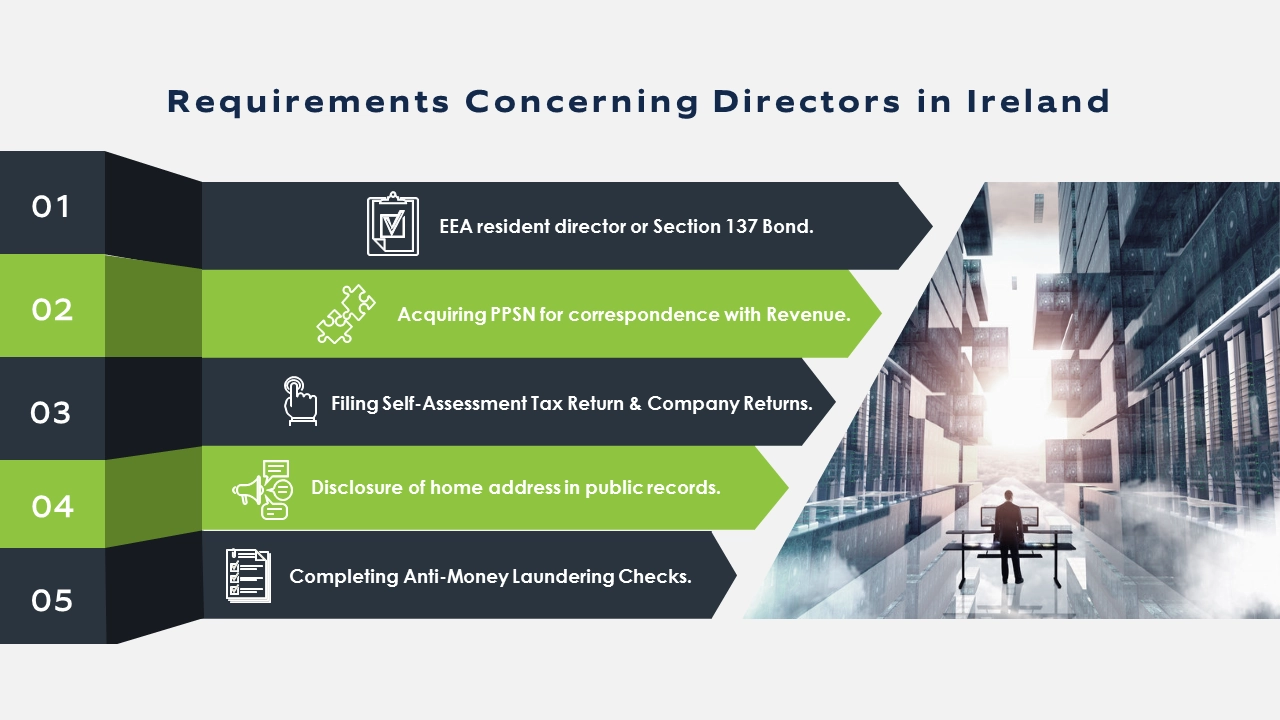

Essential Considerations for Directors When Setting Up Business in Ireland

When setting up a company in Ireland, it is essentially required to have at least one resident director in any of the EEA member countries. This applies to a company relocating from the UK as well.

Where the company cannot have a resident director, the company has to have a bond in place for the non-EEA resident directors, termed the Section 137 Bond. This serves as a security or insurance cover for any penalties or tax liabilities that the company may become liable to pay.

Where both of the above requirements, that is, having a resident director or lodging a non-EEA resident company director bond, are not met but the company can show that it has a ‘real and continuous link’ with one or more of the economic activities in Ireland, the company can apply to the Revenue for exemption of these requirements.

Some other requirements for directors include the following:

⦁ Personal Public Service Number (PPSN) – This is the unique reference number required for any communication or submission of documents to agencies like the Revenue. If you are not a citizen of Ireland, you need to apply for a PPSN.

⦁ Filing tax returns and annual returns – A director of an Irish company must file a personal tax return under the self-assessment regime. It should also ensure that the company files the Annual and corporation tax returns.

⦁ Disclosure of home address – The directors in Ireland must disclose their residential address, which forms part of the public record unless it can be proved that it gives rise to security concerns.

⦁ Anti-Money Laundering (AML) Checks – All the directors and shareholders for companies in Ireland need to complete several checks, including residency, identity and AML checks.

Compliance Requirements Relevant to Company Secretary

Unlike the companies in the UK, a company in Ireland must have a Company Secretary appointed to take care of its compliance matters required under the provisions of the Companies Act 2014. In addition, they are entrusted with statutory responsibilities, including maintaining statutory registers, keeping a record of the minutes of the board and member meetings and filing the company’s annual returns with the CRO.

One can act as a Company Secretary when the company has multiple directors in a company with a single director; a separate person is appointed as a Company Secretary. A professional entity can also take the role of a Company Secretary on behalf of your company. Our package for Company Secretarial Services can provide you with complete peace of mind regarding this requirement’s compliance.

Corporate Tax and Value-Added Tax (VAT)

One of the lucrative factors businesses considers setting up their presence in Ireland is the lower tax rate of 12.5% offered to the corporates. However, the companies must show that they have regular trading business in Ireland. The Revenue carries out central management and control tests to ascertain whether the company is eligible for the 12.5% tax rate. The critical questions that are included in this test include:

⦁ Where the company policies are decided?

⦁ Where are the investment decisions made?

⦁ Where is the head office of the company located;

⦁ Where do the majority of the directors reside? and

⦁ Where are major contracts defined?

If most of these questions provide evidence of the presence in Ireland, the company will be treated as a resident in Ireland and will be able to benefit from the lower tax rate

Regarding VAT registration, it is essential to show that the company is actually involved in trading in Ireland involving taxable activity. This is because the threshold for turnover when the VAT registration becomes obligatory is €37,500 and €75,000 for selling services and goods, respectively.

Moving Your UK Company to Ireland is Much Simpler When We Handle Matters for You!

We provide comprehensive packages, from setting up the company and secretarial service to facilitating you with the company’s registered office address. Talk to one of our Support Agents today to discuss any queries you have and benefit from our professional guidance and assistance in helping you achieve an informed start to your business in Ireland.

get a quick quote

Post Category

- Banking (1)

- Company Formation (3)

- Guides (6)

- Uncategorized (28)