Opening Up A Branch Or A Subsidiary In Ireland

30 Dec, 2022

30 Dec, 2022

Are you looking to establish your business’s presence in Ireland? One of the first questions that arise is whether to set up a branch or a subsidiary for your company. It can be a little complicated to understand all the ins and outs of setting up your business presence in Ireland while you are an overseas entity. Our guide will help you develop an understanding of all the relevant aspects regarding the setup and compliance matters related to a branch or subsidiary in Ireland.

For overseas business owners looking to set up a subsidiary or branch in Ireland, our recommendation is to seek professional advice before getting on the journey of expanding the business in Ireland. We equip our clients with all they need to know before getting started and are here to assist you every step of the way.

Let us first understand the meaning of the terms branch and subsidiary.

What Does A Branch and A Subsidiary Mean?

A branch is an extension of an overseas company and performs similar business operations.

A subsidiary is an independent legal entity and is either wholly or partially owned by the foreign company.

Differences in Setting Up A Branch or A Subsidiary

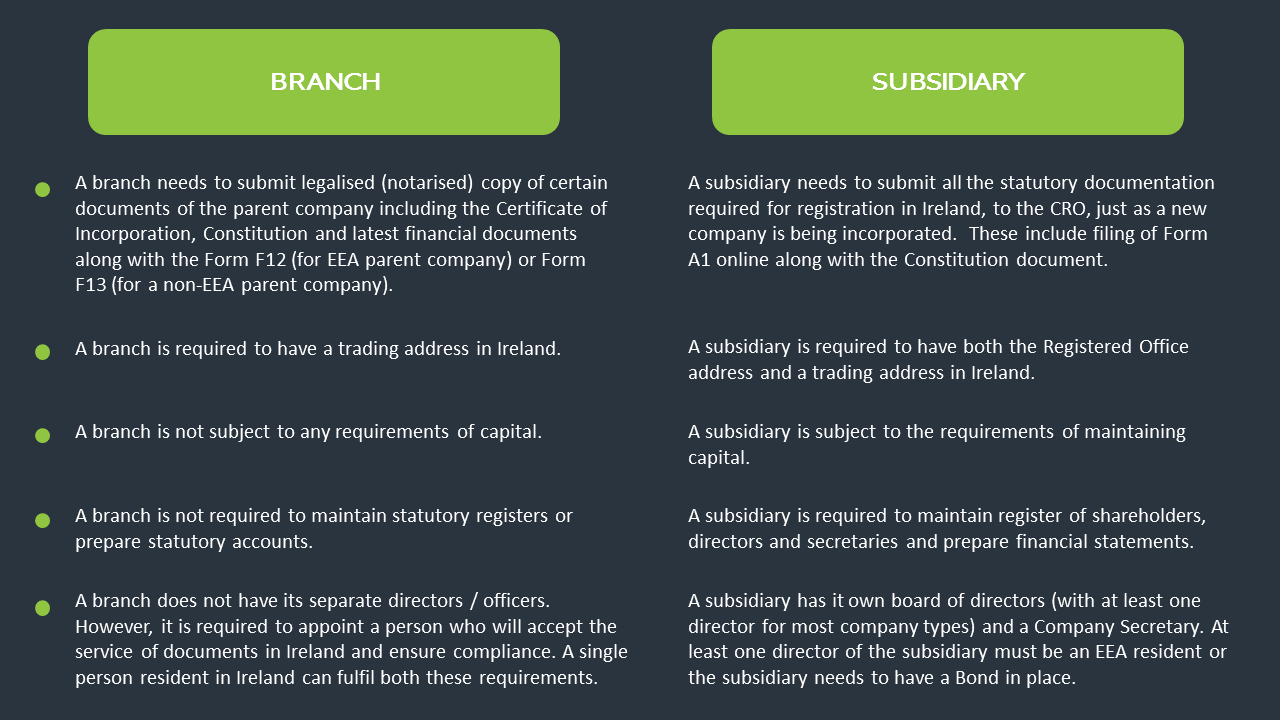

In contrast to a branch that acts like a foreign office of the parent company, a subsidiary is incorporated as a separate legal entity, and its procedure of setting up and compliance requirements are similar to opening a new company in Ireland. Some primary points of difference are as under:

How Are Tax Obligations Different for A Subsidiary or Branch?

A subsidiary and a branch of a foreign company are required to register for tax in Ireland and are subject to the requirements of filing a tax return and paying Corporation tax. A subsidiary is required to pay Ccorporation tax on profits earned worldwide. On the other hand, a foreign parent company may be liable for tax on the branch’s profits in Ireland. Similarly, when a subsidiary or a branch employs staff, it becomes subject to the tax liabilities of an employer.

Since tax implications are unique to the entity’s operations, due to the nature of business and tax residency status, it is recommended to get professional advice from our team at Fusion Formations.

Compliance Requirements for A Branch and Subsidiary

The filing and compliance requirements of the CRO for a subsidiary are similar to an Irish company. It is required to file the Annual Return and company accounts to the CRO every year. In contrast, a branch files Form F7 along with the financial statements of the foreign company.

Furthermore, a subsidiary is required to notify the CRO of any changes to the company’s structure and also maintain a Register of Beneficial Owners. A branch is also required to inform the CRO about any fundamental changes to the company, such as changes to the directors or authorised representatives or modifications to the Constitution of the foreign company. It should also notify the CRO about any changes to the registered address of the branch.

Some Common FAQs Regarding Setting Up A Branch or Subsidiary

Do I have to be present in Ireland to set up a branch or subsidiary of my company?

It is possible to set up your company’s branch or subsidiary in Ireland without being present in Ireland, a company formations agent like Fusion Formations can handle all the documentation and processing on your behalf. However, it is important to know that the documentation submitted to the CRO for registering your setup in Ireland requires the original signatures of all the directors of the company.

What is the cost of opening a branch or subsidiary in Ireland?

The application for registration with the CRO costs €60 for submitting Form F12 or Form F13 for a branch. For registering your subsidiary, the filing fee for online submission of Form A1 is €50.

How long does it take to open a branch or a subsidiary?

The time it takes for the CRO to process your company’s registration application for the branch or subsidiary depends on which time of the year you have made the application. You can always get an estimate of the expected time the CRO will take to process the application.

The Way Forward…..

We understand that it can be both exciting and daunting to think of business expansion in foreign countries. We have helped many clients set up their business in Ireland and assisted them throughout the process of registration and thereafter with their company compliance and secretarial requirements. Feel free to call us today.

get a quick quote

Post Category

- Banking (1)

- Company Formation (3)

- Guides (6)

- Uncategorized (28)