Tax and Compliance Requirements for New Companies in Ireland

02 Dec, 2022

02 Dec, 2022

When starting up a new business in Ireland, it is essential to be aware of the fundamental requirements relating to the tax and company laws applicable to your company. Our helpful guide below will equip you with the preliminary knowledge of what needs to be in place before you can start flying off with your business goals.

Before You Move On, Ensure Your Company is Correctly Set up

The first step in setting up your business is its registration as a lawfully incorporated company. While forming your company, you need to make sure that all the necessary documents are submitted to the Companies Registration Office (CRO) using the CORE website. This includes the submission of:

- Form A1 – This is the application for company incorporation;

- The company’s constitution – The constitution for a Private Company limited by shares consists of the Articles of association only. All other companies have a constitution comprising of both the Articles and Memorandum of association; and

- The registration fee – This is the cost of €50 for submitting the documents to the CRO.

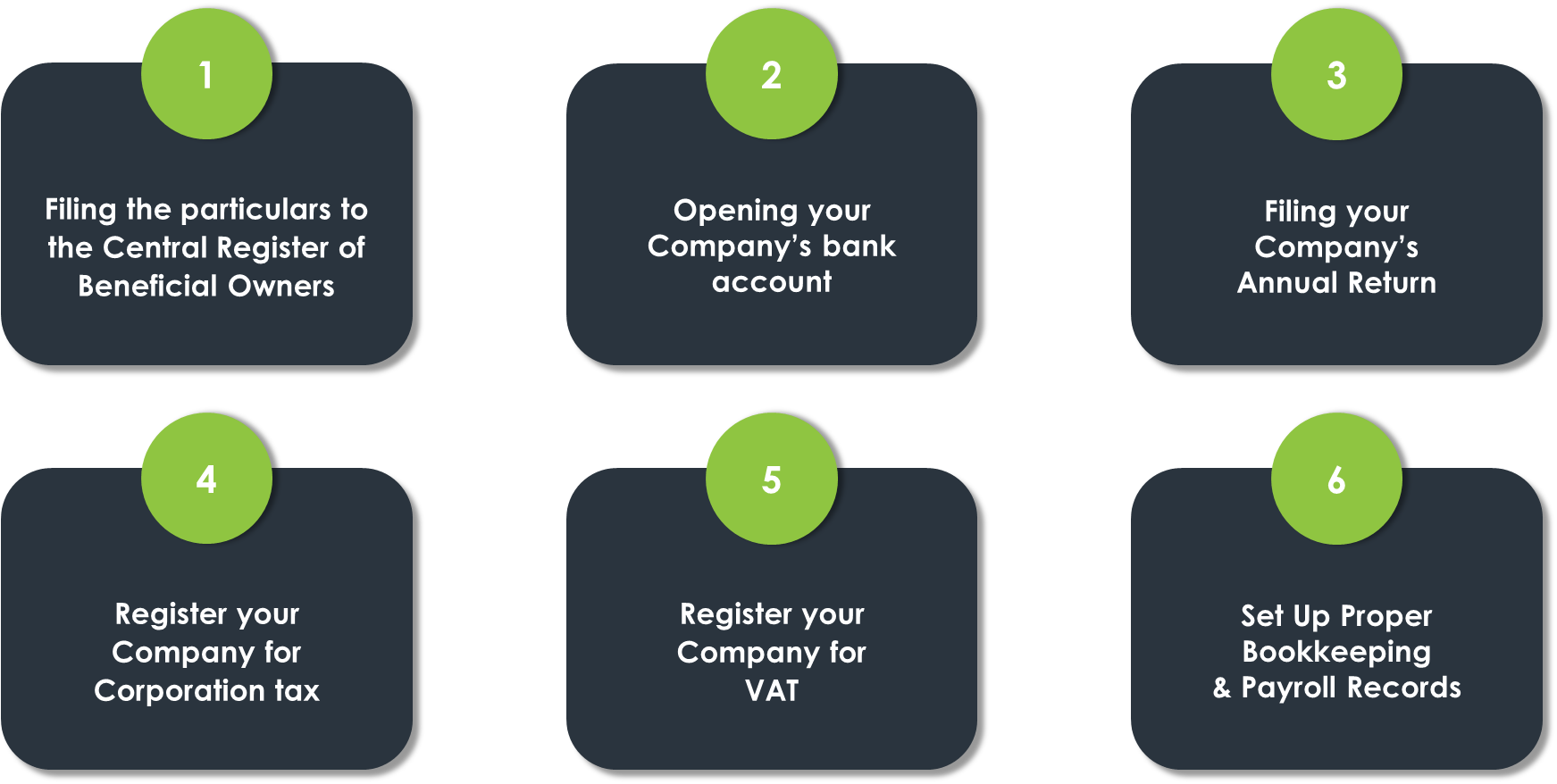

6 Requirements to Fulfil After Registering Your New Company

Once your company is incorporated, you will receive its number and Certificate of Incorporation, after which you can proceed with the rest of the steps.

1. Filing the particulars to the Central Register of Beneficial Owners

You must submit the particulars of all the beneficial owners of the company to the online portal on the RBO’s website. A beneficial owner is an individual who holds (whether directly or indirectly) more than 25% of the ownership interest in the company.

This is one of the primary requirements to be completed by the new companies that are to be completed within 5 months. Failure to comply with this requirement can lead to huge penalties, so it is important not to overlook it. Furthermore, many banks require the registration of beneficial owners to be in place before opening a bank account for your company, so it is best to get this done as a priority.

2. Opening your Company’s bank account

Once you are done with the requirement for registering the beneficial owners, you can now contact different banks to open a bank account for your company. Spend some time finding out the rates and benefits that they can offer for your business. After assessing the choices, you can go ahead with opening the bank account. This, in most cases, is relatively quick and you can easily do the entire procedure online.

3. Filing your Company’s Annual Return

All companies in Ireland are required to file an Annual Return each year. The first Annual Return of your company becomes due for filing after the first 6 months of its incorporation.

- Your company’s Annual Return Date (ARD) is determined on the date of its incorporation;

- You can check your company’s ARD on the CORE website.

- You have 56 days after the ARD to deliver the Annual Return to the CRO along with the company accounts and the signature page.

We advise you to make a note of your ARD so that you do not miss the deadline.

4. Register your Company for Corporation tax

The next step is to get your company registered for Corporation tax. This should be done prior to carrying out any trading transactions or raising any invoices to the customers. Registering your company with the Revenue is important since failing to do so can result in the strike-off of your company by the CRO. You can register yourself using eRegistration on the Revenue’s Online Service (ROS), which is the cheapest and quickest way to register for the purposes of tax.

You must be wondering what rate of corporation tax will be applicable to your company – Most companies resident in Ireland are charged corporation tax at 12.5%. A higher rate of 25% applies to the non-trading income.

Not sure if your company is tax-resident in Ireland?…. The rate that is applicable to your business depends on whether your company is a tax resident in Ireland and the nature of its income. Usually, a company is treated as a tax resident in Ireland when it is incorporated in Ireland (except where it is treated as a tax resident in another country under the Double Tax Treaty), and it is therefore charged at the tax rate of 12.5% on its worldwide trading profits. Furthermore, if a company is controlled and managed in Ireland, it will be regarded as an Irish tax resident, regardless of its country of incorporation.

It is best to get early advice from a professional as to which tax rate would apply to your company’s profits so that you can anticipate the expected tax costs.

5.Register your Company for VAT

A common question for many business owners, when setting up a business is whether I should register my business for VAT. If you expect that your annual turnover will exceed the threshold set by the Revenue, you should consider registering your company during the initial months of the incorporation. Giving you an idea about the thresholds applying to most businesses:

- For a services business – you should register if your turnover is more than €37,500.

- For a supply of goods (and services) business – you should register if your turnover is more than €75,000 (where 90% of the turnover comes from the supply of goods).

It can take up to 28 days to register for the processing of your VAT registration application. It is advisable to start early so that you have enough time to have everything in place.

6. Set Up Proper Bookkeeping and Payroll Records

Alongside the above matters, it is essential to keep track of all the income and expenditures of the company. This is achieved by using appropriate bookkeeping and payroll system(s). It is essential to fulfil the requirements or respond to any queries from the CRO and Revenue regarding evidence about the business income and expenditures. Maintaining these systems will not only let you know how well your business is doing but will also help you generate the company accounts to be submitted to the CRO every year or prepare timely responses to such queries.

How Can Fusion Formations Assist You? We realise that taking care of all these compliance requirements can be daunting independently and without seeking professional help.

Our company formation agents have thorough expertise and knowledge to facilitate you through the initial journey of setting up your business. Talk to one of our agents on 00353 1 4013286 today.

get a quick quote

Post Category

- Banking (1)

- Company Formation (3)

- Guides (6)

- Uncategorized (28)