What are the Different Types of Companies in Ireland?

16 Dec, 2022

16 Dec, 2022

Starting a business in Ireland and unsure about which type of company to set up? When setting up a company for your business, it is important to understand what options are available considering your company’s circumstances, the industry it will operate in, the business goals and the aspects related to tax and compliance.

Choosing the right type of company can be puzzling, and it is always wise to discuss your circumstances with a professional company formation agent like Fusion Formations. Here, we have listed the different company types, along with a brief explanation of each, to give you a preliminary understanding of the available options.

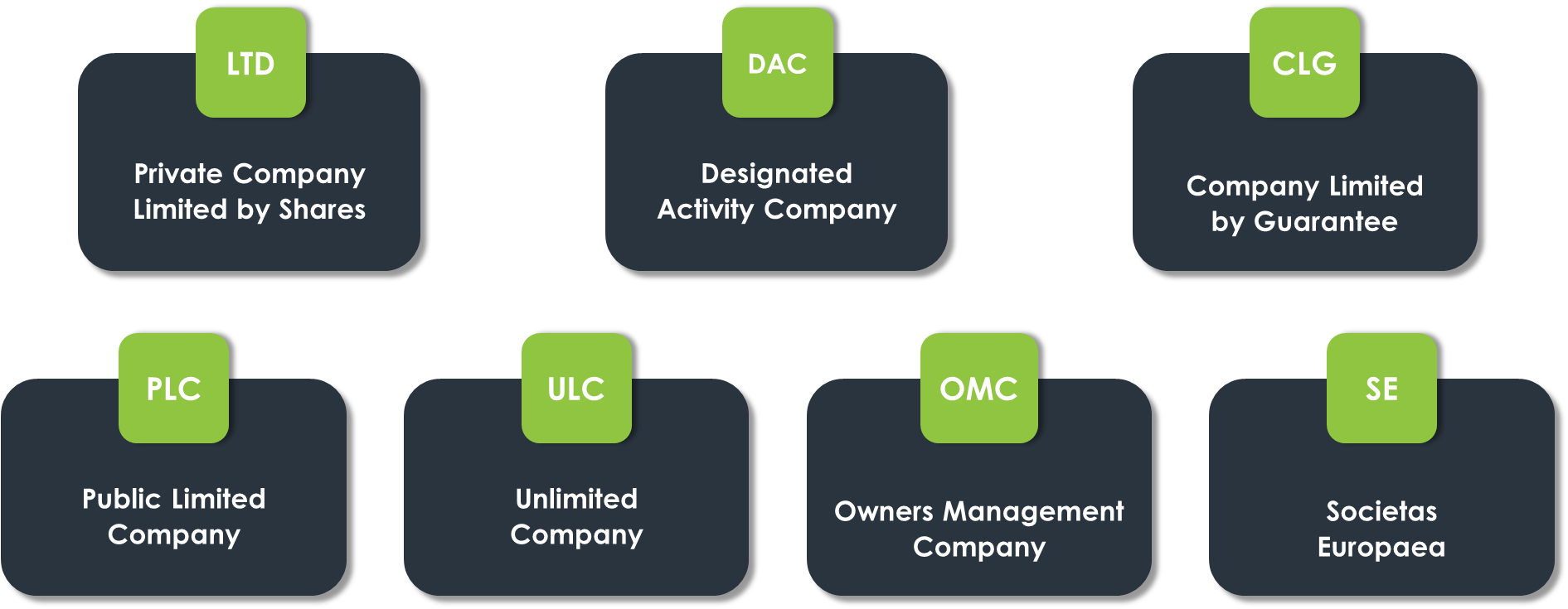

Types of Companies in Ireland

All companies that are registered in Ireland are governed under the Companies Act 2014. The fundamental features of each are listed below:

1. Private Company Limited by Shares (LTD)

- This is the most common type of company structure used by businesses in Ireland.

- A Limited Company operates under a Constitution which sets out the rules for its operations and can carry out any permitted business, as the directors and shareholders consider suitable.

- The shareholder’s liability is restricted to the amount unpaid on the shares.

- Such companies file an Annual Return each year and a small/medium sized company is required to file abridged accounts to the Companies Registration Office.

2. Designated Activity Company (DAC)

- A DAC can be a private company limited by shares or a private company with share capital and is limited by guarantee.

- Signified by its name, a DAC carries out only the designated activities that are mentioned in its Memorandum of Association.

- It must have at least two directors and a company secretary; the maximum number of shareholders is 149.

- This type of company structure is suitable for insurance companies or joint ventures.

3. Company Limited by Guarantee (CLG)

- It has a constitution which includes Memorandum and Articles of Association.

- CLG does not have a share capital, but it is a limited liability company.

- The liability of its members is restricted to the amount agreed by them, not being less than €1, to be contributed if dissolution occurs.

4. Public Limited Company (PLC)

- A PLC lists it shares on the Stock Exchange to be offered to the public.

- There is no maximum number of shareholders.

- A PLC is required to issue a minimum share capital of €25,000.

5. Unlimited Company (ULC)

Unlimited companies can take the following three forms:

- Private unlimited company with share capital

- Public unlimited company with share capital

- Public unlimited company without share capital

The members of the Unlimited Company do not have a limited liability. It must have at least one member, while the minimum number of directors is two.

6. Owners Management Company (OMC)

- OMCs are created to oversee multi-unit development or managed estates with at least five residential units.

- The owner of each residential unit is entitled to have membership in the OMC.

- It is governed by a constitution document.

- It is required to submit an annual return and hold an annual general meeting.

7. Societas Europaea

A Societal Europaea (SE) is a European public limited company formed under EU regulation.

- SEs can be created as a holding or subsidiary company, by merger, or by converting a PLC.

- It can operate as a single entity throughout the EU.

- It has its legal framework.

Further Questions? We Can help…..

The above explanation must have helped you to understand the basics of each form of company structure. There are several considerations to assess before deciding which type of company would suit your business best. Get in touch with our company formations agent today, who will advise you regarding the pros and cons, based on your individual circumstances.

get a quick quote

Post Category

- Banking (1)

- Company Formation (3)

- Guides (6)

- Uncategorized (28)